14 Nov 2025

You know that split second between your acceptance letter arriving and your enthusiasm fading when somebody says, “But how are we going to pay for it?” It is at that point that most dreams start to wobble. Not that students cannot do it, but that the financing feels like a wall you have to climb blindfolded.

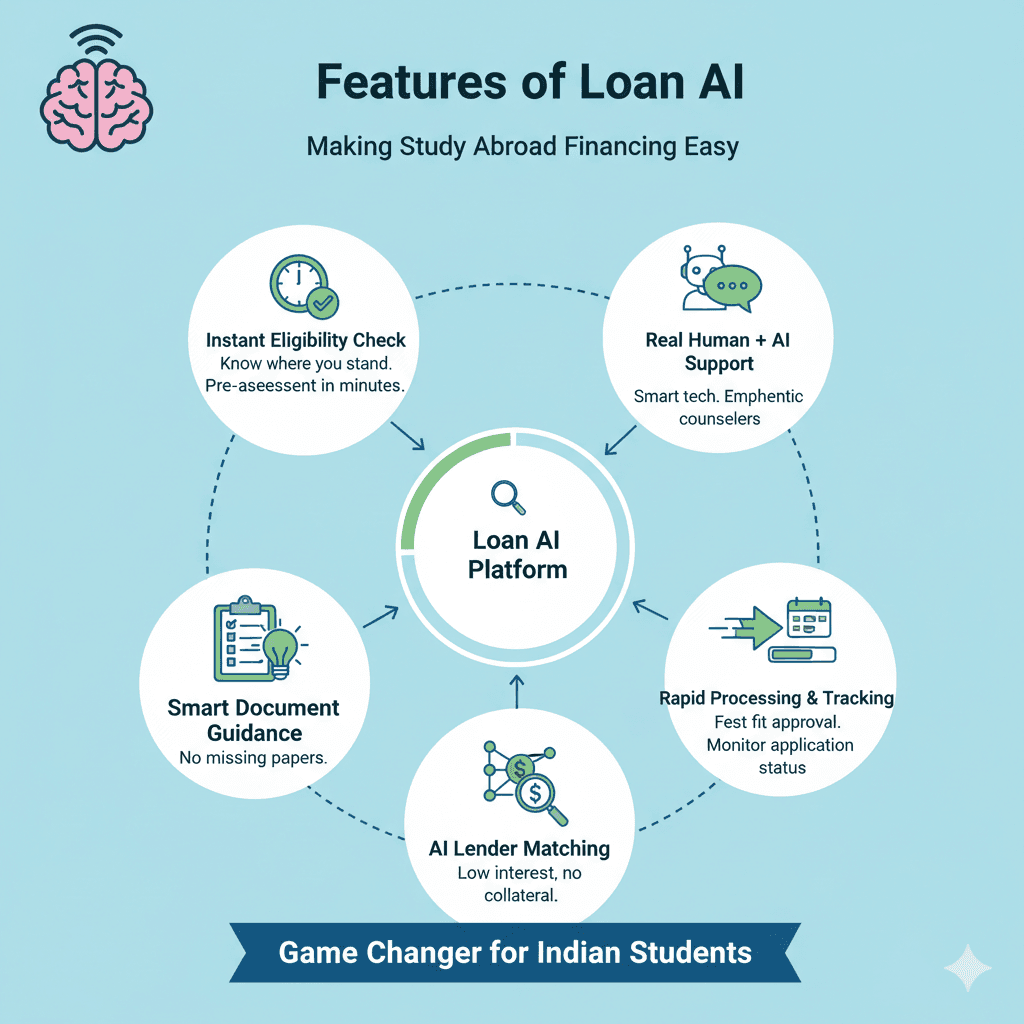

Loan AI was built for that exact moment -- to make sure hope doesn't get crushed under paperwork and long queues. It is not a fancy buzzword, but a helper that actually works. An education loan platform built by machine-learning, that can scan hundreds of lenders, read your profile, and give you instant insight of what you can get - but never again the old-fashioned come back in a week schlock. It is a pocket torch in time of flux.

Think of Loan AI as your digital buddy who speaks every financial language -- the banker's logic, the lender's caution, and the student's anxiety. It is no other cold gateway with shapes, but an ingenious money-lender, who listens to your story, and knows your history and discovers the true remedies instead of excuses.

At its core, Loan AI is an AI loan approval system designed to do the heavy lifting for you. It investigates your education and financial needs in order to be able to match you with lenders that are in fact best suited to your profile as compared to the arbitrary choices that will waste your time. Minutes later, you are notified of the amount you can borrow, interest rates to be paid and on what probability of being approved.

But it doesn't end there. The system also goes as far as picking you up and steering you through every step of the study abroad loan process which will include collection of documents, verifying of documents and liaising with the counsellors of Edysor and the trusted network of GyanDhan. No hidden clauses, no language that cannot be understood. Just simple and direct support that places your financial existence in the smooth track, faster and, last, but not the least, fairer.

To tell the truth- loans are boring and paperwork feels endless. But Loan AI changes that experience completely. That is what makes it so game changer among the Indian students:

The first thing Loan AI does is show you where you stand -- no sugarcoating, no false hopes. In minutes, you will know whether or not you are eligible, whether you will receive low-interest rates and what lenders are likely to give their approval. It is like having pre-view of your opportunities before you even submit any application.

It is this aspect that only helps students avoid disappointments in the future.

We have all heard how awful paperwork can be, you fill out some papers, send them off and some bank worker calls back to inform you that you have left some documents out. Loan AI fixes that.

Using its AI education loan system, it offers you a customized checklist based on your profile. When you need the income evidence of a co-applicant, or a signed admission letter or maybe a blocked account document, it lets you know beforehand.

No confusion. No missing papers. No rejection because of an incomplete file.

This is where the partnership between Edysor and GyanDhan comes alive. The AI loan approval system is connected with the big network of banks, non-banking financial institutions, and even international lenders that GyanDhan offers. It provides you with the best loan depending on your profile, low interest, no collateral, fast approval, etc.

You don't run after lenders. Loan AI brings them to you.

Monitoring of all processes such as application, sanction, etc is carried out. You can check where your file is stuck, who is reviewing it, and when the next update is expected.

That is the harmony that all the students need.

Though the system is completely automated, there is no time when you have to work alone. The Edysor counsellors are never left behind - they decode the information, call out the banks where necessary and can be a helping hand on the rough sections.

So it's not just an app. The interaction between smart technology and concerned human beings is what has to happen.

Together, these features make Loan AI more than a platform -- it's a personalized support system for students trying to finance their future abroad.

The study abroad loan process can look overwhelming, but with Loan AI, it's actually quite straightforward. We shall proceed step by step in the manner it operates.

You start by providing some general details about yourself; the university, course, family income, and country of choice. Within seconds, Loan AI runs your profile through its smart algorithms and gives you a pre-assessment.

You'll instantly know:

This is where the smart loan assistant comes in very handy. Most of the loans get rejection because of insufficient or incompleteness of paperwork. Loan AI fixes that problem.

A document checklist is prepared to suit your case - admission letter, co-applicant documents, bank statements and anything that is relevant to your case.

It makes you much organized and makes you submit everything on the first attempt. No surprises later.

It is here that magic happens. The official partner of Edysor is GyanDhan that presents an enormous partnership with the state banks, NBFCs and foreign lenders.

The AI loan education platform scans this network and identifies the best lenders to you in every case - a no-collateral loan, a speedy sanction, the lowest rate.

It’s personalized matchmaking for loans – efficient and data-backed.

Having decided on a lender, the team members of GyanDhan and Edysor do the dirty work. The Loan AI dashboard tracks every update -- from approval to disbursement.

As both teams are working to ensure that the lenders are held accountable, it will not have lagging problems.

It is not hard: Edysor and GyanDhan created the system with the most demanded aspects of students: fast, clear, and helpful.

It is not just a lifeline to thousands of students, but it is a service.

Traditional bank lending can feel like a full time job. But Loan AI turns it into a guided, effortless journey. The new system is miles superior to the old one due to the following reasons:

Before Loan AI, students would apply blindly to banks without knowing their actual eligibility. At this point, when the evaluation has the backing of AI, you are already informed about your chances - you will not feel disappointed in the future.

The greatest reason for rejections? Missing/uncompleted paperwork. The latter is prevented by the AI education loan platform that checks all information and brings concerns prior to it.

No one can wait weeks before receiving an update. With Loan AI, the processing is faster because most verification happens automatically. A few days will be required to approve.

The AI loan approval system does not need to be limited to one or two banks, you are connected to a large pool of lenders, and all of them are filtered according to your course, destination and financial profile.

There is no guesswork in respect of fees, interest and terms of repayment. This is everything on the surface so that the families could plan.

The best part of Loan AI is its hybrid nature. Technology processes accuracy and speed and counsellor’s processes empathy and clarity. You possess one of the rights, and one of the human.

You do not have to be in the cities of Delhi and Mumbai in order to receive the best deals. Students from smaller towns can access the same network of lenders through Loan AI, breaking the big-city advantage.

All is in order, you can view it therefore, you and your parents do not need to waste time in the pursuit of papers and approvals to organize your studies.

The reason behind this is that partnering with GyanDhan will help in facilitating time-sensitive lenders. The one who procrastinates will always have people behind him/her.

Through repeated interactions, students also start understanding loans, interest, repayment terms and therefore makes them more knowledgeable borrowers in future.

In short, Loan AI turns a stressful process into a structured experience. You no longer have to worry that you will get the loan yet you start planning your life in the university with much confidence.

Such is the peculiarity of Edysor they do not merely give you a platform and leave you to figure it out. They dictate to you what to do everywhere and in everything.

A simple counselling call is the start of the whole process of each student. Edysor's team gathers your profile, course, and financial background -- ensuring Loan AI starts with full context.

You go through the Loan AI steps, while counsellors stay available to explain results, clarify doubts, or adjust strategies based on what the AI finds.

Before the counsellors can submit the documents, they will go through them twice to ensure that there are minimal risks of the document being rejected.

Once you have found out your ideal lenders, the team of Edysor would then get in touch with the team of GyanDhan experts to make the approvals fast.

Human nature should not be neglected. Loans create stress in families. Edysor counsellors do so with moderation, and express every term in clear language.

Such an integration of AI loan lending system and the human hand will ensure that none of the students will feel lost or confused. It is almost having an ally within the financial space - something that fully understands its business.

Q1. How is Loan AI different from regular loan services?

Unlike traditional portals, Loan AI gives instant eligibility results, guided document helps, and real-time tracking -- all in one place.

Q2. Can I get a loan without collateral through Loan AI?

Yes! The AI education loan service connects you to the lenders that focus on the study loan with no security.

Q3. How fast is the process?

Most of the students are pre-approved during a duration of 24-48 hours and finally sanctioned in less than a week.

Q4. Does it charge hidden fees?

No. Loan AI is completely transparent -- you'll always know what you're paying for.

Q5. What if my loan gets delayed?

To make this process take a short duration, Edysor and GyanDhan jointly make follow-ups with lenders.

Q6. Can it be applied to me in situations when I am not living in large cities?

Yes! It is virtual and can be used anywhere and there is no issue of location.

An experience in a study abroad must be aimed at fulfilling dreams, and not grades. However an Indian student has gone through long paper work, approved and waiting assignments over the years.

Loan AI changes that. It gives the students control, clarity and confidence. It simplifies all the procedures including the process of eligibility and approval but it does not depersonalize.

The students are no longer afraid of funding, as Edysor and GyanDhan cooperate. They receive at least a fast, honest and supportive system.

So if you've been putting your plans on hold because of loan stress, maybe it's time to meet the future -- and it's called Loan AI.

Because your dream deserves more than waiting. It deserves the smartest help possible.

Resources

Others

All rights reserved. Powered by Edysor