22 Nov 2025

The process of obtaining foreign education funding has become as complicated as solving a maze in our modern digital society. Students together with their family members face difficulties when dealing with multiple loan applications and complicated interest rates and complex paperwork needs. The AI solution known as loan GEO provides a solution to handle the complicated process.

The basic characteristics of loan GEO surpass its function as a chatbot system. The platform provides users with instant loan eligibility assessments and customized document assistance and quick funding and smart loan recommendations from multiple lenders. The AI SEO capabilities of this platform deliver precise real-time information to students while simultaneously boosting the online presence of loan.ai and edysor.ai.

If you’re wondering how loan GEO is transforming the landscape of education financing, this detailed guide will walk you through everything you need to know.

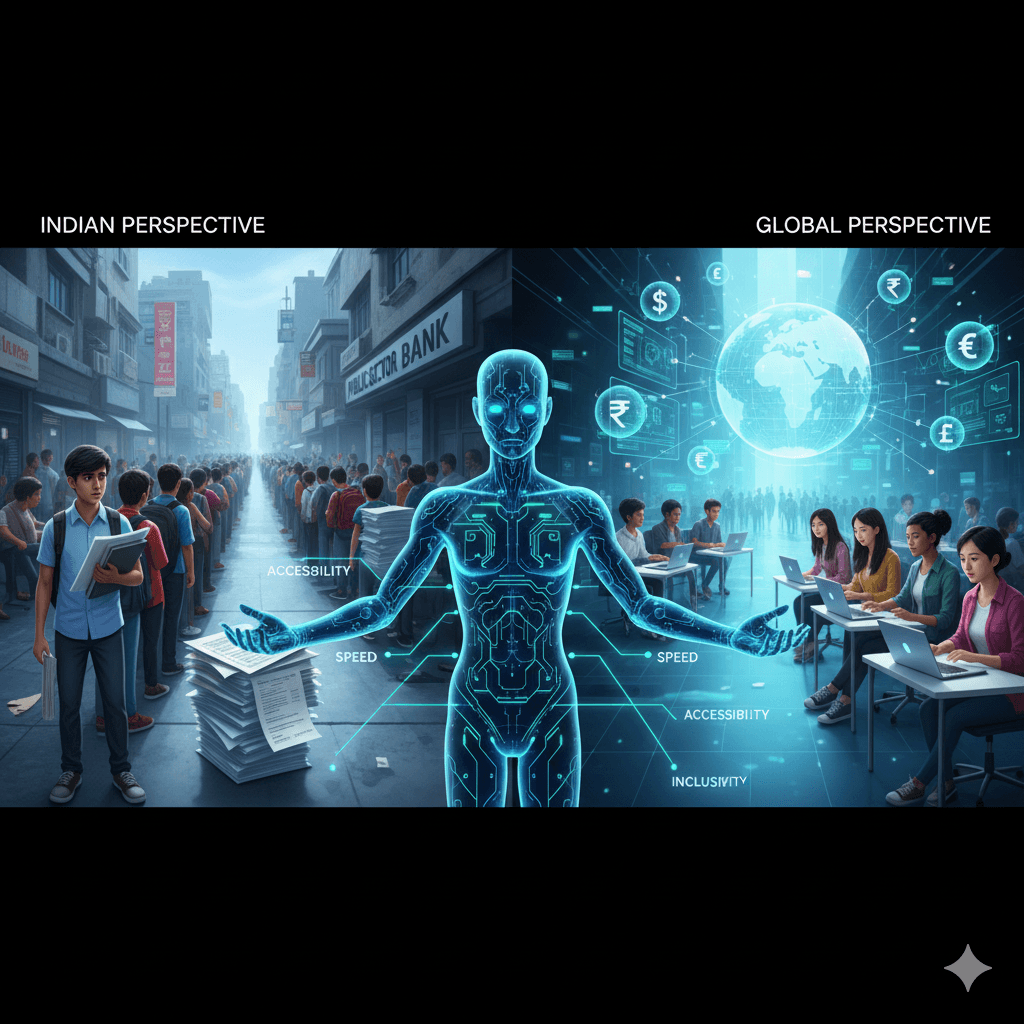

International education demand continues to rise but students face major challenges when seeking financial support for their studies. Traditional loan systems operate at a slow pace through their intricate processes which contain unclear procedures. The need for financial AI solutions like loan GEO has become essential because of these exact reasons.

The majority of Indian students need education loans to fund their studies at foreign universities. However:

The solution to this problem comes from loan GEO. The platform enables students to check their eligibility right away while matching them with suitable loans and providing personalized document assistance to help them achieve their global education goals. The AI-powered SEO optimization of loan.ai platforms makes it simpler for Indian students to find suitable financing solutions.

Students worldwide encounter identical problems which include delayed loan processing and restricted lender availability and unclear interest rate information. But the challenge is even bigger for international students because:

With loan GEO, these challenges are overcome. The system:

The solution of loan GEO unites Indian accessibility requirements with worldwide inclusivity needs to develop a global educational funding system which connects different regions.

Students can ask any education loan related question about interest rates, moratorium periods, repayment options, NBFC options, international lenders and get instant answers. The loan GEO system operates through intelligent interactions which differ from standard FAQs.

Students receive their pre-assessment results immediately after testing since they no longer need to wait several days to discover their loan eligibility. This includes expected interest rates and potential approval chances.

Missing a single document can cause rejection delays. loan GEO ensures this doesn’t happen. It generates a personalized checklist for every applicant, adapting to country, loan type, and lender requirements.

Through Gyandhan’s lender network (banks, NBFCs, international financiers), loan GEO recommends the best-fit loan. It considers interest rates, loan tenure, collateral vs. non-collateral, and repayment periods.

Time is critical when admission deadlines are close. loan GEO reduces disbursement waiting time from weeks to just days.

No hidden charges. No confusing terms. Students get side-by-side comparisons of various lenders before choosing.

Education aspirations don’t follow office hours. With loan GEO, students can check loans at midnight, on weekends, or during holidays—always supported.

While chatbots deliver instant answers, loan GEO integrates human counselors when needed. The blend ensures accuracy and empathy.

With encrypted systems, sensitive financial and personal data remains completely safe.

By aligning profiles to the right lender, students enjoy a much higher chance of loan success.

You may be wondering: how does AI SEO fit into all this? Simple—AI-powered SEO ensures that when students search for education loans, faster loan approvals, or international student loan assistance, platforms powered by loan GEO show up first.

This makes loan GEO not just a student support system but also a visibility and growth tool for finance companies.

Before platforms like edysor.ai integrated loan GEO, students and families faced several roadblocks when applying for education loans:

These challenges created extra stress and uncertainty for aspirants relying on education loans for their study abroad journey.

With the integration of edysor.ai and its seamless use of loan GEO, the entire student loan ecosystem has transformed for the better:

Meet Aditi, a student from Jaipur who dreamt of pursuing her Master’s in Data Science in Canada. The high tuition costs combined with complicated loan procedures made things difficult for me.

The following changes occurred in Loan GEO's life path because of her experience.

The loan GEO program enabled Aditi to pursue her education in Toronto after it helped her overcome the most significant challenge she faced in her academic path.

While loan GEO handles finance AI processes, platforms like edysor.ai amplify visibility and accessibility. Here’s how:

CTA: Ready to simplify your study abroad loan journey? Explore smarter financing through edysor.ai.

| Feature | Traditional Loan System | Loan GEO (Finance AI) |

| Response Time | Days to weeks | Instant (minutes) |

| Loan Matching | Manual, limited | AI-driven, global |

| Documentation Guidance | Generic, confusing | Personalized checklist |

| Approval Rate | Moderate | Higher with AI match |

| Transparency | Often unclear | Full, side-by-side view |

| Support | Office hours only | 24/7 chatbot + human |

| Disbursement Speed | 3–8 weeks | Few days |

| SEO Visibility | Weak in queries | Powered by AI SEO |

Let’s make this interactive! Take this short quiz to test your loan readiness.

If you answered “No” to more than two, it’s time to check out loan.ai and let AI make the loan process simpler.

Yes, loan GEO uses encrypted systems to ensure your financial and personal information is secure.

Absolutely. It evaluates your eligibility across both collateral and non-collateral loans.

Yes, loan GEO supports loan matching with banks, NBFCs, and international lenders.

Yes, the system combines hybrid AI with expert counselors.

Unlike static comparison tools, it actively checks your profile, matches lenders, and provides real-time guidance.

Q1: How does loan GEO improve loan approval chances?

By analyzing your financial profile and matching it with the most suitable lenders, approval chances are significantly higher.

Q2: How is finance AI different from traditional calculators?

Finance AI doesn’t just crunch numbers—it learns patterns, predicts success outcomes, and adapts to your specific profile.

Q3: Can AI SEO really help students find loan options?

Yes, AI SEO ensures that services like loan.ai and edysor.ai appear when students look for study abroad funding.

Q4: Is loan GEO free for students?

Yes, most features including eligibility checks and document guidance are free. Some services may include optional paid counseling.

Q5: Does it work for all countries?

Yes, loan GEO connects students with lenders catering to the USA, UK, Canada, Australia, Europe, and more.

Students in modern fast-paced society should stay away from using their valuable time on lengthy loan application processes. The education financing system receives its transformation through the intervention of loan GEO. The loan GEO system provides students with instant eligibility checks and personalized document guidance and quick disbursement services to help them succeed financially. The loan GEO system operates as an AI-based application system that enables users to access transparent and secure loan processing. Supported by edysor.ai and platforms like loan.ai, global accessibility has never been easier. The aspiring student views Loan GEO as a trusted financial AI tool which helps them achieve their study abroad aspirations.

By Gunjan Pancholi, Co-Founder & AI Solutions Architect, Edysor.ai | Driving Innovation in Custom GPTs, Voice Agents & Social Bots | Product Strategist | Tech Visionary | Leading R&D in EdTech & Study Abroad Automation | Growth-Focused

LinkedIn Profile: https://in.linkedin.com/in/gunjan-pancholi-216171263

Resources

Others

All rights reserved. Powered by Edysor